Economic Impact of Short Term Rental Restrictions

In July, the Isle of Palms City Council rejected the First reading of ordinance 2023-12 with a vote of 5-4. This ordinance proposed a cap of 1,600 licenses for all short-term rental properties. As a result of this decision, the matter will now be presented as a referendum in the upcoming November election, allowing the public to vote on capping the number of short-term rentals island-wide

While there has yet to be a specific study on the economic effects of the short-term rental restrictions on the Isle of Palms, we can look to similar restrictions in our local area and nationwide to gauge the potential impact of this new law on the island.

Here are some of those examples as we discuss the economic impact of short term rental restrictions.

Short term rentals contribute significantly to the local economy

Tax revenue

For decades, the Isle of Palms has benefited from the presence of short-term rental properties. These rentals have consistently contributed significant revenue to the island, benefiting its residents. It’s well-known that short-term rentals enhance tourism. This increase in tourism leads to more substantial revenue, which funds essential municipal services that elevate the quality of life for all.

Moreover, the taxes collected from these short-term rentals also lead to higher earnings for local businesses. As a result, restaurants, shops, and other establishments see an uptick in their income, further increasing the city’s hospitality tax revenue.

Property values

A potential economic advantage of short-term rentals that might be overlooked is their positive impact on property values. Owners of short-term rentals tend to spend more on maintaining and upgrading their properties. This not only boosts the value of their property but can also raise the overall property values in the surrounding area.

A study by the Harvard Business Review analyzed nationwide residential data and found that properties used as short-term rentals sold for 38% more, attributing this increase to the owner’s investments in renovations and maintenance.

What happens to the local economy when short term rentals are restricted?

The short-term rental restrictions have a long-term economic impact that spans generations. These limitations can severely harm local businesses, reduce tax income and lower property values.

Tax revenue

Real Estate Weekly reported that short-term rental restrictions have caused a notable drop in tourism. This decline in tourism results in reduced revenue, affecting the range of services that local municipalities, such as Isle of Palms, can provide.

When local governments, like Isle of Palms, face substantial reductions in tax revenue due to policies like short-term rental restrictions, they often seek to compensate by raising other taxes, such as sales and property taxes, for their residents.

Property value

A more alarming statistic found in the Harvard Business Review’s study on short term rental restrictions was their finding about their effect on property values:

“We conservatively estimate that for the 15 cities we studied, STR restrictions reduced property values by a total of $2.8B and tax revenues by $40M per year.”

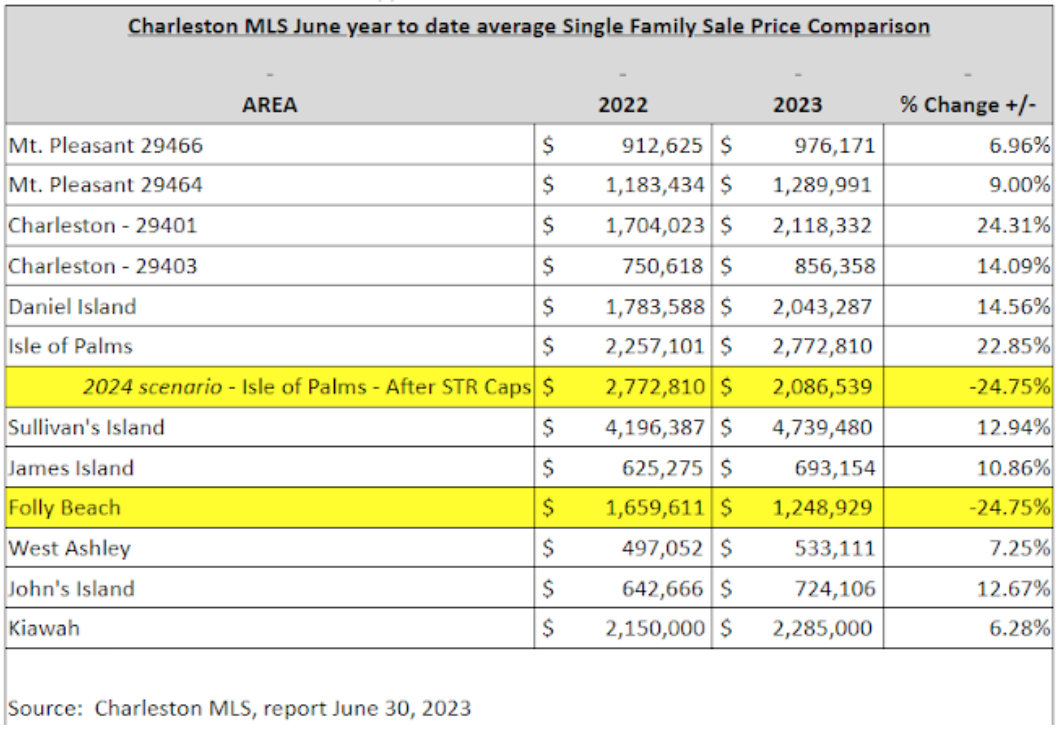

Folly Beach implemented a short-term rental restriction in February and has seen a 25% drop in property values (according to MLS) in just six months since the law’s passage!

The people of Isle of Palms will make a decision in November that will significantly impact the island’s economic future. Before you vote, please consider the consequences of a short-term rental restriction on our community.